Vietnam Minimum Wage Update 2026|New Regional Wage Levels Under Decree 293/2025/NĐ-CP

The Vietnamese Government has officially issued Decree 293/2025/NĐ-CP, announcing the new minimum wage rates (monthly and hourly) effective January 1, 2026.

These rates match the draft proposal released during the summer and are now legally confirmed.

This article explains the new minimum wage levels, the regional classifications, and the important application rules businesses must follow, especially if they operate across multiple locations or within industrial zones.

目次

- 1. New Regional Minimum Wage Rates (Effective January 1, 2026)

- 2. Regional Classification (I–IV) Is Specified in the Decree Annex

- 3. Application Rules: What Businesses Must Understand

- Rule 1. Apply the wage level of the location where work is performed

- Rule 2. If your company has multiple branches or factories

- Rule 3. Industrial Zones, Export Processing Zones, and High-Tech Parks

- Rule 4. When administrative units are renamed, merged, or divided

- Rule 5. When a newly established district is formed from multiple regions

- 4. Impact on Salary Structure and HR Costs

- 5. Key Takeaways for Japanese and Foreign Companies in Vietnam

- 6. Summary: 2026 Will Require Strong Wage Planning and Compliance

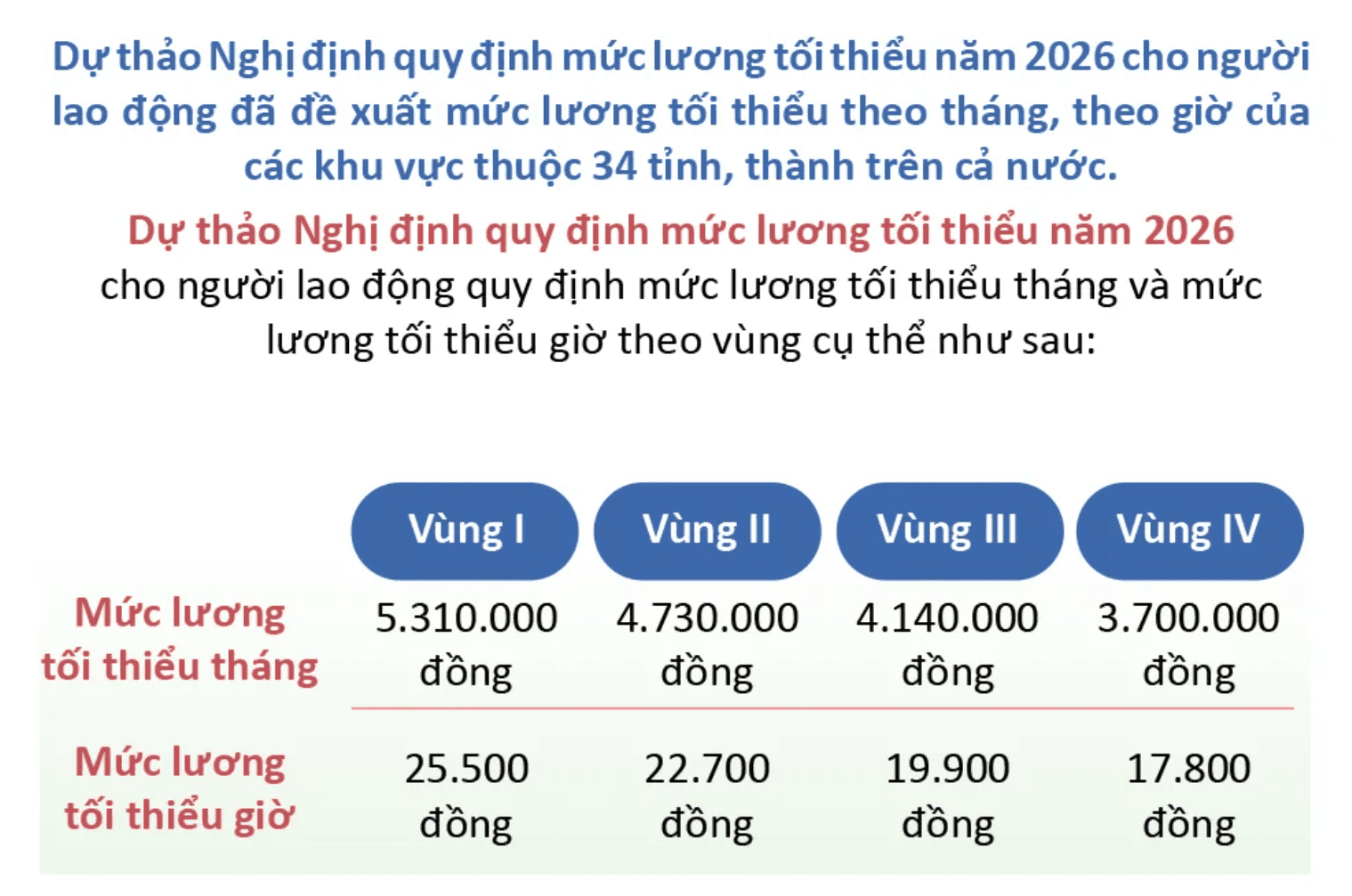

1. New Regional Minimum Wage Rates (Effective January 1, 2026)

Vietnam’s minimum wage system is divided into four regions (I–IV) based on economic conditions, cost of living, and labor market characteristics.

Below are the new levels defined under Decree 293/2025/NĐ-CP:

Minimum Wage by Region – 2026

| Region | Monthly Wage (VND) | Hourly Wage (VND) |

|---|---|---|

| Region I | 5,310,000 | 25,500 |

| Region II | 4,730,000 | 22,700 |

| Region III | 4,140,000 | 20,000 |

| Region IV | 3,700,000 | 17,800 |

Region I covers major economic centers such as the central districts of Ho Chi Minh City and Hanoi.

Regions III and IV cover smaller provincial cities and rural areas.

2. Regional Classification (I–IV) Is Specified in the Decree Annex

The annex of Decree 293/2025/NĐ-CP lists all provinces, districts, and sub-districts categorized into Regions I–IV.

Typical categorization patterns include:

- Region I: Central districts of HCMC and Hanoi, major economic zones

- Region II: Large suburban districts, key industrial zones

- Region III: Medium-sized provincial cities

- Region IV: Rural, agricultural, and less-developed areas

Businesses should refer to the official annex for the precise classification relevant to their location.

3. Application Rules: What Businesses Must Understand

Minimum wage must be applied based on the employee’s actual workplace, not the company’s legal headquarters.

This becomes particularly important for companies with multiple sites.

Rule 1. Apply the wage level of the location where work is performed

Example:

- HQ in Region I

- Factory in Region III

→ The factory must apply Region III minimum wage.

Each location must follow its own regional rate.

Rule 2. If your company has multiple branches or factories

Each branch must apply the minimum wage defined for its specific address:

- HCMC (Region I) headquarters

- Dong Nai (Region II) factory

- Can Tho (Region III) sales office

→ Three different minimum wage rates apply.

Rule 3. Industrial Zones, Export Processing Zones, and High-Tech Parks

If an industrial zone spans multiple regions:

The highest (most expensive) region’s minimum wage must be applied.

This is one of the most frequently misunderstood points and often causes compliance issues.

Example:

A zone spreads across Region II and Region III

→ Region II must be applied.

Rule 4. When administrative units are renamed, merged, or divided

Until the government issues an updated classification:

Apply the previous regional minimum wage temporarily.

Rule 5. When a newly established district is formed from multiple regions

Until the government announces the official classification:

Apply the highest regional wage among the original areas.

Example:

A new district is created from parts of Region II and Region III

→ Region II wage applies temporarily.

4. Impact on Salary Structure and HR Costs

The minimum wage revision affects more than just basic salary.

Companies must carefully review related HR and labor cost structures.

1. Base Salary Adjustments

If an employee’s base salary is below the new minimum wage, it must be increased.

2. Social Insurance Contribution

Social insurance contributions use the minimum wage as a baseline.

An increase in minimum wage may lead to higher insurance contributions.

3. Overtime (OT) Calculations

Overtime rates are calculated using the employee’s salary base.

If minimum wage rises, OT costs may increase accordingly.

4. Recruitment Costs

Higher minimum wages in Regions I and II (HCMC, Hanoi, major cities) may intensify competition for labor and increase hiring costs.

5. Key Takeaways for Japanese and Foreign Companies in Vietnam

Region I now exceeds 5.3 million VND per month, requiring adjustments for many employees.

Stronger cost pressure for manufacturing companies

Industrial parks in Regions II and III will see notable cost increases for large workforces.

Competition for talent will intensify

Minimum wage adjustments narrow the gap between employers, making non-wage benefits and company culture more important.

Industrial zones require special attention

If an industrial zone spans multiple regional classifications, the highest region’s wage applies, regardless of factory location inside the zone.

6. Summary: 2026 Will Require Strong Wage Planning and Compliance

The 2026 minimum wage revision introduces:

- Higher monthly and hourly wages across all regions

- Location-based wage application for each branch or facility

- Special rules for industrial zones and newly established districts

- Administrative transitions requiring temporary wage application

By understanding these rules and adjusting salary structures early, companies can reduce compliance risks and manage labor costs more effectively.